The government has acknowledged that it has broken its own domestic debt ceiling, to a level which it calls ‘unhealthy domestic borrowing.’

The amount of debt that the government has acquired from the domestic market has gone up to Shs.6.8 trillion Shillings which is more than 1 per cent of Gross Domestic Product (GDP), initially set as the maximum.

The total debt, foreign and domestic will grow to 52 per cent by the end of the financial year, which is also above the 50 per cent ceiling that Uganda has agreed on with the other East African Community countries, with the support of the International Monetary Fund. On the whole, the region’s debt stock has risen to USD 112 billion or 58 per cent of the GDP (2019), with Kenya and Rwanda having the highest ratios.

The debt levels have been further pushed up by the effects of the COVID-19 pandemic and the need to contain it. With economic growth declining sharply and in some cases to negative rates, there are now calls for the governments to go for credit relief and other measures. Equally, there are growing calls for the International Monetary Fund (IMF) to approve the issuance of Special Drawing Rights (SDRs) to assist developing countries in their economic recovery.

The SDR is an international reserve asset, created by the IMF to supplement its member countries official reserves. So far SDR 204.2 billion (equivalent to about USD 281 billion) have been allocated to members, according to the IMF. The United Nations Conference on Trade and Development (UNCTAD) estimates that Africa will require USD 200 billion to address the financial and socioeconomic impacts of the global pandemic.

At a dialogue between government and the civil society, the Uganda Debt Network, SEATINI Uganda, Civil Society Budget Advocacy Group (CSBAG), Transparency International and the African Forum and Network of Debt and Development, urged other countries to press the IMF to release up to USD 3 trillion.

However, the organisations have cautioned the government that even if these options mature to their favour, there is a need to control the rate of borrowing. UDN Executive Director, Julius Kapwepwe says that if Uganda and the other countries are to borrow, they should borrow for sectors that directly improve the livelihoods of the masses.

The government is also accused of being extravagant with both own and borrowed resources, which is a result of poor planning. Seatini Uganda Executive Director Jane Nalunga gives the example of the high cost of administration, saying the many administrative units are created without putting in mind the cost of maintaining them.

The Ministry of Finance, Planning and Economic Development says domestic borrowing has gone up to 1.1 per cent of GDP and will go further up to 1.6 per cent next financial year. Samson Muwanguzi Joash, the Acting Assistant Commissioner in the Domestic Debt Office, says domestic debt cannot be avoided because of its benefits over foreign debt.

He says much as foreign debt interest rates are lower, the loans carry other costs like conditions and the risks associated with changes in foreign exchange rates over the loan period. Domestic loans are also easy to get since they are acquired from within the country, which makes them good for emergency case borrowing.

Muwanguzi says, the government had projected the domestic debt level to rise to 6.3 trillion Shillings, but this will go to 6.8 trillion when it acquires the loan for the initial investment in the East African Crude Oil Pipeline this month.

Meanwhile, the government of Uganda is planning to issue an infrastructure bond to fund infrastructural programs without borrowing from banks. A bond is an instrument issued by the government or a company that needs to borrow money. Basically, the person who gets the bond invests in the said project and is paid after the date of maturity, with interest.

The government can decide to buy back the papers before the date of maturity. Acting Commissioner, Muwanguzi says the plan is on to issue the bond, but the government has not yet decided on the date for issuing it.

URN

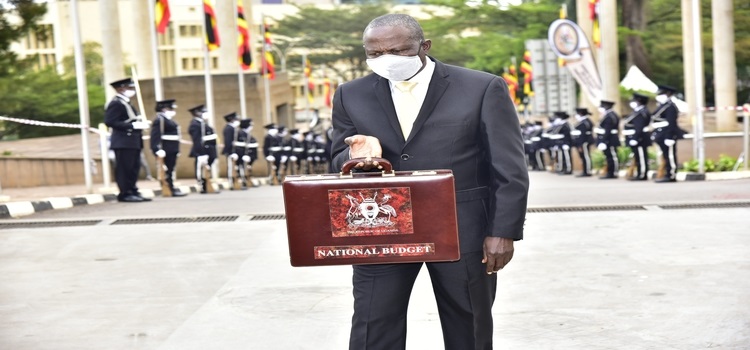

Finance minister Matia Kasaija