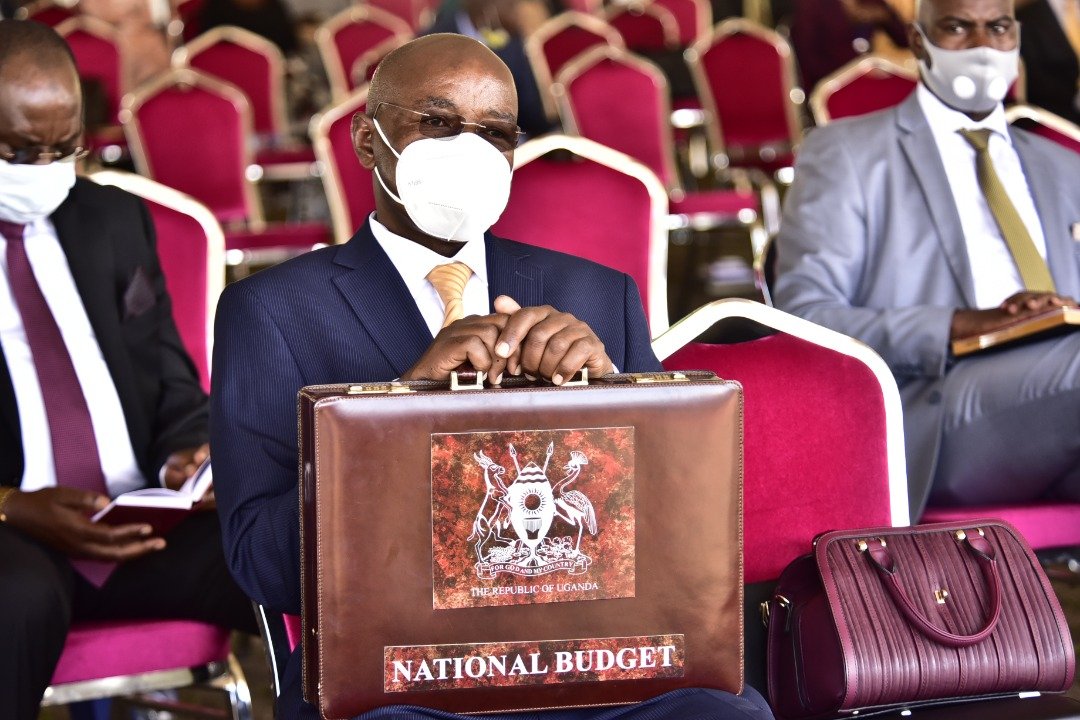

Kampala. As government grapples with a huge public debt and revenue collection constraints, it has introduced six other taxi policies to support the Shs.44 trillion budget that will run the country in the financial year 2021/22, presented by the State Minister of Finance and Economic planning, Amos Lugoloobi.

Domestic revenue from domestic collections is anticipated to be Shs22.425 trillion.

Presenting the budget at Kololo Independence grounds on Thursday, Mr Lugoloobi said taxes will be realized from enhanced efficiency in tax collection by the Uganda Revenue Authority (URA). He said compliance will be strengthened.

The new tax policies will see reforms in taxation of rental revenue; reviewing the capital gains tax regime by allowing for the effect of inflation and providing tax relief for venture capital investments, broaden the scope of taxation of plastics to cover all plastics.

Other policy, will include rationalization of the excise duty regime on telecoms- scrapping the excise duty on OTT but introducing a 12 per cent tax on airtime, and internet data save for data meant for medical and education services.

A 7 per cent levy of Fish Maw exports, 5 per cent and 10 per cent on processed and unprocessed gold and other minerals respectively.

See full budget speech

PREAMBLE

Your Excellency the President,

Your Excellency the Vice President,

The Right Honourable Speaker of Parliament,

Your Lordship the Chief Justice,

The Right Hon. Deputy Speaker of Parliament,

The Right Honourable Prime Minister,

Honourable Ministers-Designate,

Honourable Members of Parliament,

Your Excellencies, Heads of Diplomatic Missions and Development

Partners,

Distinguished Guests and Ladies and Gentlemen.

1. Mr. Speaker, in accordance with Article 155(1) of the Constitution of the

Republic of Uganda and the Public Finance Management (PFM) Act 2015; and in exercise of the power delegated to me by H.E the President of the Republic of Uganda, I have the honour to present the Budget Speech for the Financial Year 2021/22 Budget.

I. INTRODUCTION

2. The Public Finance Management Act 2015 requires that the budget is approved by Parliament prior to the beginning of the financial year. This being a year when general elections were held, the budget for Financial Year 2021/22 was approved by the 10th Parliament on 7th May 2021. My statement today is therefore, a summary of the budget as approved by that Parliament. I thank all the Honourable Members of that Parliament, for the excellent cooperation in the preparation and approval of the Budget.

Mr. Speaker Sir, Ugandans have once again renewed the mandate of the NRM Government. I heartily congratulate His Excellency the President upon his victory. I also extend congratulations to you, Mr. Speaker and Madam Deputy Speaker, for your election to the high office of Speaker and Deputy Speaker, and to you my colleagues the Honourable Members of Parliament for your election to the 11th Parliament.

4. Mr. Speaker, over the last year, the Corona Virus pandemic has severely impacted the health, economic and social status of Ugandans. Several aspects of life were adversely impacted, though evidence shows resilience and we should congratulate ourselves as a country.

According to a study by the Economic Policy Research Centre (EPRC) and the International Growth Centre (IGC), only 10% of Micro, Small and Medium Enterprises in Uganda remained open during the lockdown, and 93% of all Micro, Small and Medium enterprises were back in operation by October 2020. In addition, 90% of employees of private sector firms who were laid off during the lockdown were subsequently hired back after lockdown, and only 6.5% suffered permanent layoffs.

5. Mr. Speaker, the economic shocks that we have faced have, interestingly, also presented us with several opportunities. We have improved efficiency in public spending by using digital solutions, thus reducing the absolute need to travel abroad and inland, and physically attend meetings and workshops. Secondly, in response to the global supply chain disruptions due to the COVID19 pandemic, several firms switched production lines to the manufacture of items that were previously imported, such as masks and sanitizers which are critical in containing the spread of the virus.

6. In addition, several locally sourced e-Commerce applications have been developed to facilitate transactions during periods of restricted movements. These, among other innovative initiatives, are homegrown and can enhance self-sufficiency, and advance our strategy for import substitution and export promotion.

7. Mr. Speaker, while Ugandans have withstood the consequences of the pandemic, its second wave is unfolding, with little certainty as to its severity and impact. This is a most serious threat to our existence today. I appeal to every single one of us to protect themselves from the virus, by strictly following Standard Operating Procedures (SOPs). I also urge people of Uganda to urgently get vaccinated.

8. Mr. Speaker, the overarching goal of the NRM government over the new term of office, is to drive faster and inclusive socio-economic transformation, building on the progress we have attained over the years.

The key to rapid socio-economic transformation in Uganda, rests on Industrialisation mainly based on agriculture, boosting private sector business, and ensuring the wellbeing of Ugandans together with the development of their skills for productive work. The budget for the next

Financial Year 2021/22, is therefore premised on the theme Industrialisation for Inclusive Growth, Employment and Wealth Creation.

9. Mr. Speaker, in this budget statement, I will do the following: –

i. Report on Uganda’s Economic and Social progress over the last five years.

ii. Present the Economic Growth Strategy and Priorities for Financial Year

2021/22 and the medium-term; and

iii. Provide the Financing Framework for the Financial Year 2021/22.

II. ECONOMIC AND SOCIAL PROGRESS

10.Mr. Speaker, the NRM Government continues to build a strong foundation for economic and social transformation. Significant achievements have been registered, highlights of which I now want to provide. More details on performance can be found in the Background to the Budget

National Output

11.Mr. Speaker, over the last year the economy has remained resilient and is on a recovery path, amidst the ongoing pandemic and other shocks experienced over time. Economic growth for this financial year is projected at 3.3%, rising from 3.0% last financial year. The economy has grown significantly over the last five years. The size of the economy has grown from Shs. 108.5 Trillion in 2016/17 to Shs 148.3 Trillion in current prices by June 2021, equivalent to US$ 40 billion.

12.Mr. Speaker, the Industry sector’s contribution to the economy has increased slightly from 26.0% in 2016/17 to 27.4% in 2020/21. However, manufacturing has significantly diversified into many new products such as ethanol from sugar, and casein and powdered milk from dairy. In addition, Uganda’s products now have a widespread regional presence. For instance, in the pharmaceutical industry, CIPLA Quality Chemical Industries Limited (CIPLAQCIL), now has a footprint in West and Southern Africa. In the steel industry, Roofings Limited has become a premier source of Steel and Plastic in East and Central Africa.

13.Mr. Speaker, scientific research and innovation is now transforming Uganda’s industrial base. For instance, the Kiira Automotive Industry that will produce 5,000 vehicles per year starting with Buses and Trucks is now 78% complete. Together with Luwero Industries, Kiira Motors has developed the Kayoola EVS, a premium zero-emissions City Bus with a range of 300 kilometres, before the need to recharge its batteries. Two silk processing factories in Sheema and Mukono have acquired State-of-the-Art Silk Yarn processing equipment to produce high quality silk products. The silk industry is projected to earn Uganda US$100 million annually, and will create at least 150,000 jobs by 2030. The National Research and Innovation Programme has also supported the development of Makapads – a non-irritating herbal sanitary pad, a low-cost ventilator to assist breathing for patients with respiratory conditions including COVID19, and a highly efficient Coronavirus Antibody Test Kit, among others.

14. Mr. Speaker, the mining industry continues to be a major contributor to Uganda’s economy. The contribution of the Mining and Quarrying industry to GDP increased from 1.1% in 2016/17 to 2.3% in 2020/21. This development is a result of the use of online mineral licensing, the biometric registration and training of 13,000 artisanal miners, and the construction of regional

mineral beneficiation centers. More mineral beneficiation centers are under construction such as the ones in Fort Portal, which is 65% complete, and Ntungamo which is 90% complete. The selection of an investor to revive the Kilembe Mines Project, under a Public-Private Partnership (PPP), has also commenced.

15.Mr. Speaker the Agricultural sector’s contribution to the economy has stagnated at around 23% over the last five years, which requires increasing the pace of industrialisation. Nonetheless, there has been increased production of agricultural commodities, including for export. For instance, Coffee production increased from 4.6 million 60-kg bags in Financial Year 2015/16 to 8.1 million bags in the Financial Year 2020/21. Over the same period, fish catches increased from 449,000 to 600,000 tonnes. Milk production has also increased from 2.1 billion to 2.6 billion litres, over the same period.

External Trade and Tourism

16.Mr. Speaker, international trade continued to flourish despite the COVID19 pandemic. Merchandize exports grew by 4.7% increasing from US$ 4.1 billion in 2019 to US$ 4.3 billion in 2020. Agricultural export values grew by 19% from US$ 1.4 billion in 2018/19 to US$ 1.8 billion in 2019/20. Happily, Uganda’s merchandise trade deficit has significantly narrowed from US$ 2,866 million in 2018/19 to US$ 2,365 million in 2019/20, a reduction of US$ 500 million in one year.

17.Coffee remains the leading agricultural export earning US$ 497.4 million in the Financial Year 2019/20. Dairy exports fetched US$ 204.5 million, while Tea exports earned US$ 71 million in Financial Year 2019/20. Fish exports earnings increased from US$ 121 million to US$ 227 million, over the same period.

18.Mr. Speaker, annual foreign exchange earnings from tourism increased from US$ 1.35 million in 2015 to US$ 1.6 billion in 2018. Annual tourist arrivals also increased from 1.3 million to 1.5 million during the same period. This is a result of the sustained investments in the development and rehabilitation of tourism infrastructure and product diversification. Unfortunately, the outbreak of COVID19 has caused a huge setback to tourism, as we all know.

Investment

19.Mr. Speaker, Foreign Direct Investment (FDI) flows to Uganda amounted to US$ 1.3 billion in 2019 increasing by 20% from US$ 1.1 billion in 2018, and Domestic Investments increased by 13% from US$ 385.3 million to US$ 433.8 million in the same period.

Incomes, Poverty and Employment

20.Mr. Speaker, Uganda’s per capita income is increasing steadily. In Financial Year 2015/16 it was US$ 808 and is projected to increase to US$ 932 in Financial Year 2020/21. We expect to achieve middle-income of US$ 1,039 within the third year of NDPIII implementation. The key reasons why we did not attain a middle-income status by 2020 are;

(i) lower than expected productivity, especially in agriculture;

(ii) inefficiencies in public investments resulting in less-than-optimal returns; and

(iii) the shocks from natural disasters, especially in the last two years.

21.Mr. Speaker, the recently concluded Household Survey reports that poverty has declined from 21.4% in 2016/17 to 20.3% in 2019/20. Poverty rates reduced in West Nile, Bunyoro, and Elgon regions, among others. However, 39% of Ugandan households are still in subsistence economy.

22.Mr. Speaker, the Household Survey also found that 68% of Ugandans work in Agriculture and 74% of Ugandans of working age are engaged in some form of employment. Formal employment has also expanded by 17% between 2016/17 and 2019/20, with the PAYE register expanding from 1.3 to 1.5 million registered taxpayers, according to the Uganda Revenue Authority.

23. In order to empower youth and women to increase self-employment and incomes, 247,700 youth have been financed with Shs. 165 billion to implement 21,000 projects under the Youth Livelihoods programme. A further 166,300 women in 13,800 groups have received funding for projects.

The externalization of labour has enabled 16,750 persons get employment in the Middle East over the last year, and remit approximately US$ 9 million per month.

Economic Infrastructure

24.Mr. Speaker, infrastructure is an important facilitator for economic growth and socio-economic development. Significant progress has been recorded as follows:-

25. Transport: Mr. Speaker, in transport infrastructure development, the total national paved road network has increased by 41% from 3,800 kilometres in 2016 to 5,400 kilometres today. 11 inland water vessels are operational with the commissioning of the Buwama and the Sigulu Ferry services. With respect to air transport, the upgrade of Entebbe International Airport is almost complete with 96% of works at the cargo complex done. Kabaale International Airport in Hoima now stands at 55.6% complete. To revive railway transport, rehabilitation of the Tororo-Gulu Meter Gauge Railway (MGR) has commenced, and 79% of the land for the construction of the Standard Gauge Railway (SGR) has been acquired. In addition, locomotives are being procured to further support Uganda Railways.

26. Power: Mr. Speaker, national electricity access today stands at 51% of which, 24% is on-grid and 27% off-grid. With the implementation of the free Electricity Connections Policy (ECP), 152,500 households have been connected to the grid. Power generation capacity has increased by 38% from 925 megawatts in 2016 to 1,274 megawatts in 2020. The completion of the Karuma hydropower plant which is 98% complete, and several minihydropower plants such as Aswa, Nyagak and Muzizi will further increase this capacity.

27.Digitization: Mr. Speaker, internet access now stands at 52% with 21 million people using the internet. Active mobile money subscriptions are 23 million served by 235,800 mobile money agents. High-speed optical fibre cable covers 3,900 kilometers. In addition, new industries have been established in the assembly of computers, mobile phones and accessories, and the development of knowledge-based ICT solutions. The ICT Innovation Fund established in 2017 has funded the local development of 115 applications many of which are in use in Government and the Private Sector. These include the Academic Information Management System (AIMS) and the eGovernment procurement solutions.

Human Capital Development

28.Mr. Speaker, the quality of life of Ugandans has improved over the last five years. Life expectancy has increased from the lowest level of 44 years in 1998 to 63 years currently. Literacy rates have improved to 76% of the population. In addition, the following progress has been recorded:-

i. 5.4 million home study books were distributed to private and public primary and secondary schools to support continuity of learning during the COVID19 pandemic;

ii. 270 teachers were trained in Early Grade reading methods for preprimary schooling, as part of the Early Childhood Development curriculum rollout this year; and 14,350 teachers were trained to provide psycho-social support arising from CoVID19;

iii. Construction of 117 seed secondary schools was completed and 64 community secondary schools at sub-counties were grant-aided;

iv. Safe water coverage in rural and urban areas is estimated at 68% and 71% respectively. Consequently, 48,000 villages, representing 70% of all villages, have at least a source of water. In urban water supply, National Water and Sewerage Corporation (NWSC) has extended

954 Kilometres of water mains and 49,000 new customers have been connected. In addition, 1,506 Public Stand posts have been installed, which serve an estimated 300,000 people; and

v. Access to healthcare as measured by the proportion of people within a 5-kilometre radius of a health facility now stands at 91%. In terms of functionality, 81% of Health Centre IVs offer caesarean section while 51% offer both caesarean section and blood transfusion. The state-ofart Entebbe Paediatric Surgery Hospital has been completed and all National and Regional Referral Hospitals have been equipped with Intensive Care Unit (ICU) beds and Oxygen plant.

CoVID19 Emergency Response

29.Mr Speaker, despite the adverse impact of the COVID19 pandemic, the economy remains resilient, partly as a result of quick and strong Government response. To minimize the negative impact of COVID 19 on the social and economic welfare of the country, direct fiscal interventions totalling 2.6 trillion were implemented. In addition, 7.3 trillion private loans in commercial banks were restructured, as part of the stimulus package. The economic stimulus supported (i) household economic welfare; (ii) firms to survive the crisis; and (iii) maintenance of financial stability to avoid the potential collapse of the economy.

30. Mr. Speaker, during the COVID19 pandemic, vulnerable groups in the Kampala Metropolitan Area were provided relief food and masks were distributed countrywide. Shs 60 billion was spent to fund food distribution to 683,000 households covering 1.9 million persons.

31. The mitigation of the adverse impact of CoVID19 pandemic on health and education, was a key element of Government response. 964,000 doses of CoVID vaccines were procured, and mass vaccination has began following the priority accorded to most vulnerable categories of the population. Today 733,923 persons have received their first dose of the vaccine and 40,895 have completed both doses. Clinical trials of a locally researched treatment is also underway. To ensure continuity of education during the COVID19 pandemic, distance learning has been used based on electronic platforms including Television and online classes. Digital platforms are also in use for inspection and supervision of schools.

32. To support recovery of business, Private sector loans totaling Shs. 7.3 trillion, representing 43% of all loans, had repayments postponed, a quarter of which were loans in Tourism, Trade, and Commerce. Tax relief totalling Shs 2 trillion was provided to businesses disrupted by COVID19. In addition, Government paid Shs. 677 billion in arrears to private sector firms it owed in order to ease their liquidity. The Uganda Development Bank was allocated Shs. 555 billion to finance manufacturing, agribusinesses and other private sector firms affected by the CoVId19 pandemic.

33.Seed capital amounting to Shs. 416 billion was provided to the youth, women entrepreneurs and Emyooga. A total of 6,394 Emyooga SACCOs in 349 constituencies have received Shs. 200 billion.

Governance

34.Mr. Speaker, with respect to law and order, crime reduced by 8.9% from 215,000 cases in 2019 to 196,000 cases in 2020. Interventions such as the Safe City Camera Project, enhanced motorized and foot patrols and community policing have contributed to this decline. In the Judiciary, the proportion of cases that are over 2 years old have reduced from 24% in 2017

to 17.5% in 2021 as a result of the implementation of the case backlog reduction strategy and the use of Alternative Dispute resolution alongside conventional court proceedings.

35.Mr. Speaker, to sum up, great strides have been achieved on both economic and social fronts, as I have demonstrated. This progress is a result of the sustained effort by the Government to remove barriers to production and human capital development, as well as peace and security, which have provided a solid basis for the economy to grow, despite the setbacks we all know. The socioeconomic transformation in Uganda is unstoppable.

III. ECONOMIC GROWTH STRATEGY AND PRIORITIES

36.Mr. Speaker, the Economic Growth Strategy for the medium term aims to achieve faster and inclusive growth and enhanced socio-economic development. The target is to raise growth rates from 4.3% estimated for Financial Year 2021/22 to at least 7% in the medium-term. The strategy that will achieve these medium-term objectives is three-fold:

i. Restoring the economy back to the medium-term growth path;

ii. Improving the wellbeing of the population to ensure a healthy and skilled workforce; and

iii. Providing peace, security and good governance.

A. Restoring Economic Growth

37.Mr. Speaker, restoring the economy to medium growth path requires the following:-

i. Boosting business of the Private Sector, especially Micro, Small and Medium (MSME) Enterprises by extending CoVID relief measures, increasing regional and continental market access, access to long term affordable capital and supporting entrepreneurial development;

ii. Aggressively promoting agro-Industrialization to unlock the potential of primary production, together with standards development and enforcement including enhanced Market Access;

iii. Commercializing Minerals, Oil and Gas endowments to obtain the greatest benefits from adding value to Uganda’s natural endowments; and

iv. Develop and Maintain Infrastructure for Economic Growth and Development and promote regionally balanced growth.

I. Boosting Business Activity

38.Mr. Speaker, the immediate requirement is to support the recovery of businesses that continue to be adversely affected by the COVID-19 pandemic.

Financing Private Sector Growth

39.Credit relief enables businesses to improve their liquidity and cashflow. The restructuring of private sector bank loans has been further extended from 1st April 2021 for a further six months, allowing restructuring of loans for upto three times. This restructuring can be applied by any borrower at any time before 30th September 2021.

40.Mr. Speaker, access to affordable medium-to-long term capital is key to boosting business. Uganda Development Bank will be further capitalized with an additional Shs. 103 billion in financial year 2021/22, in addition to the Shs. 555 billion disbursed this Financial Year 200/21 for lending to Small and Medium Enterprises affected by the COVID19 pandemic, among others.

The Agricultural Credit Facility (ACF) at the Bank of Uganda, the Emyooga programme through the Micro Finance Support Centre (MSC) and the Uganda Women Entrepreneurship and Youth Funds will continue to provide targeted funding for agriculture, women and youth group projects respectively.

41.Mr. Speaker, Applied Research in science, technology and Innovation are key to industrialization and socio-economic transformation. Significant gains in productivity and competitiveness can be achieved with product development. To further support advancement in scientific research and innovation, the construction of the National Automotive Park will commence next year. Feasibility studies for Regional Science and Technology Parks and Technology and Business Incubators will also be carried out. Technology development for the manufacture of Personal Protective Equipment (PPE), Diagnostics and Bio-medical science,

Immunology, Vaccines and Digital Applications will be further supported.

42.Mr. Speaker, Shs. 358.5 billion has been allocated in next year’s budget for innovation and technological development.

Investment Promotion

43.Mr. Speaker, in order to promote investment, foreign and domestic direct investment will be facilitated. This will increase value addition, as well as enable technology and knowledge transfer. 350,000 direct jobs and 650,000 indirect jobs are expected to be generated. To this end, 23 regional Industrial Business Parks to be spread across the country, will be established, among others.

II. Promoting Agro-industrialization

44.Mr Speaker, Agriculture remains the mainstay of livelihoods for the vast majority of Ugandans in rural areas who engage in primary production and related non-farm activity. The key to rapid socio-economic transformation rests on unlocking the potential of agriculture through aggressive industrialisation. This will enable the population engaged in farm and nonfarm rural economic activity to earn higher incomes and employment.

45. The Agro-industrialisation strategy will address low production and productivity of primary agriculture, poor post-harvest handling and storage, limited value addition and insufficient market access. It will also permit adherence to food safety requirements and standards in export markets.

This will also partially address the reason provided to create Non-Tariff Barriers (NTBs) in regional markets, which constrains agribusiness.

The Parish Development Model Approach

46.Mr. Speaker, the Parish Development Model is an approach to organizing and delivering public and private sector interventions for wealth creation including investment planning, budgeting and service delivery at the parish level as the lowest planning unit. This approach seeks to create income generating opportunities at the 10,594 Parishes in the country.

47. The Parish Development Approach has Seven (7) pillars, namely:

i. Production, processing, value addition and marketing;

ii. Infrastructure and other economic services including extension services, energy, roads, market structures, water for production and mind-set change for business orientation;

iii. Financial Inclusion through cooperatives, SACCOs, Revolving Funds where Ushs 30 million will be provided per Parish for a start;

iv. Social Services delivery including health, education, water, and other social development services.

v. Re-establishment of the Community Information System.

vi. Parish Governance and Administration.

vii. Mind-set Change.

48.Mr. Speaker, agro-industrialization will be achieved through the following strategic actions:-

i. Develop Commodity Value Chains linking national, regional, district and sub-county level commodity off-takers to private nucleus farmers.

This will enable the production of the 14 key commodities under the Parish Development Model, including maize, cassava, banana, beans, Irish potato, sweet potato, millet, sugar cane, cattle (beef), dairy, coffee, tea, cocoa and fish;

ii. Multiply fish, poultry and crop technologies developed by National Agricultural Research Organisation (NARO) and improved breeding stock by National Animal Resources Centre and Databank (NAGRC&DB) to be replicated across the country using the Parish Development Model;

iii. Build parish and sub-county centres and district and regional warehouse storage capacity with adequate equipment to address post-harvest losses and ensure standards are maintained. In this regard the Parish Development Model will go a long way to organize local production linked to processing centres and markets;

iv. Provide affordable long term agricultural financing and insurance to de-risk entrepreneurs at all levels of the Commodity Value Chain;

v. Expedite the licensing of digitized commodity markets linked to the 750,000 MT capacity of warehouse infrastructure country wide, where volumes of quality (aflatoxin free) graded grain will be guaranteed and traded; and

vi. Develop market infrastructure to enable the private sector to take advantage of the export market opportunities including the African Continental Free Trade Area (AfCFTA).

vii. Develop agro-industries such as the Luweero Fruit Factory, and the masterplan for the Zombo Fruit Factory, etc.;

viii. Complete construction of storage facilities of 42,000 Metric Tonnes capacity in Iganga, Isingiro, Amuru, Kalungu, and Nebbi;

ix. Operationalize 20 Zonal Industrial hubs for skilling youth and women, wealth creation and value addition, for Carpentry, Welding, Tailoring, Knitting, Weaving, Bakery, Shoe Making, and Stone Cutting trades, and value addition facilities for commodities such as Coffee and Maize;

x. Construct 2 storage facilities in Bunyangabu and Katakwi; 6 milk collecting centres in Kyenjojo, Gomba, Nakaseke, Kumi and Kibuku; 12 food processing plants and 18 Value addition facilities across the country;

xi. Operationalize a 1,000 metric ton Grain processing plant and a 150 kg per hour Peanut butter plant in Soroti; a 3,000 metric ton Maize processing plant in Busia, and a 500metric Tonne Multigrain Processing Plant and Feed mill in Arua; and

xii. Establish the Kabarole Agro-Industrial Park, two (2) Regional Value Addition Incubation Centres (RVAICs) in Kasese and Gulu; and two (2) Regional Farm Service Centres (RFSCs) in Gulu and Kabarole.

49.Mr. Speaker, Uganda’s agricultural exports are required to meet international Phytosanitary standards. These standards ensure that agricultural commodities for export are free of pests and diseases. Eight (8) major border posts will be constructed and equipped to carry out inspection, testing, fumigation and packaging services for exports. They will be located at Mutukula, Katuna, Mpondwe, Malaba, Busia, Suam, Elegu, and Lwakhakha and at the Entebbe and Kabale International Airports. This will address quality standards for commodity exports such as maize and poultry and dairy products. Shs. 7 billion has been provided for this purpose.

50.Mr. Speaker, in total Shs. 1.67 trillion has been allocated to support agroindustrialization initiatives next financial year.

Commercialising Minerals, Oil and Gas Endowments

51.Mr. Speaker, exploitation of Uganda’s minerals, oil and gas endowments, is a major source of growth in the medium term. Mineral beneficiation adds economic value to naturally endowed minerals. The commercialization of our oil and gas endowments will generate investments of between US$ 15 –20 billion over the next five years. The requirement to have these investments with substantial local content will enable the creation of jobs and allow local companies to benefit from supplying goods and services to the petroleum sector.

52. Recently, the Governments of Uganda and Tanzania signed agreements that will facilitate the undertaking of the Final Investment Decision by the oil companies. These agreements will accelerate the production of the first oil.

Investment requirements in this sector will now present an opportunity for Foreign Direct Investment inflows, creation of both direct and indirect jobs, facilitate local enterprise growth, including forward and backward linkages to agriculture, tourism, and petrochemical industries. I thank the President for his foresighted leadership in guiding and spearheading the development of this sector.

53.Mr. Speaker, the priority interventions in the mining industry next financial year are as follows:- –

i. Establish the mineral reserves that are economically feasible for extraction in 80% of the country, and complete the airborne geophysical surveys of the remaining 20% in the Karamoja sub-region;

ii. Finalise the mining law and enhance Public Private Partnership (PPP) arrangements to develop minerals, starting with iron ore in Western Uganda, restoration of the Katwe Salt Factory and provision of an attractive taxation regime that protect and support local steel production.

iii. Explore all the geothermal resources to quantify the geothermal potential of the country and promote the development of Kibiro, Katwe, Buranga and Panyimur geothermal prospects.

54.Mr. Speaker, Shs. 49 billion has been allocated in the budget for Financial Year 2021/22 to support the mineral development interventions.

55.Mr. Speaker, in the oil and gas industry, critical actions that have now paved way for investment and commercialisation include the signature of agreements between Uganda, Tanzania and the International Oil Companies (IOCs) for the East African Crude Oil Pipeline (EACOP). The enabling legislation for the EACOP (EACOP Bill) will soon be brought to Parliament for consideration.

56.Mr. Speaker, the signature of these key agreements signals the commencement of the development and production phase of petroleum.

Construction of Tilenga and Kingfisher facilities as well as the East African Crude Oil Pipeline (EACOP), will commence this year and first oil is expected in early 2025. This development will create significant benefits to our economy and to all Ugandans, especially those who will participate in provision of services and goods to the industry. In addition, the following interventions will be undertaken:-

i. The second licensing round of exploration areas will commence in order to enable discovery for additional petroleum reserves;

ii. the construction of oil roads will continue;

iii. the National Content Policy that provides priority to Ugandans to supply the oil and gas industry and provide employment, will be implemented;

iv. Construct facilities for production and transportation of the crude oil, and the development of the required regulations including those related to tariff, metering, and decommissioning.

III. Infrastructure for Economic Growth and Development

57.Mr. Speaker, Uganda has invested heavily in addressing key infrastructure gaps. But there are still gaps that will be addressed in the medium term to enhance growth and socio-economic transformation, for which the following interventions will be implemented.

Transport Infrastructure

58.Mr. Speaker, to further improve transport infrastructure, the following interventions will be prioritised next financial year: –

i. The upgrade of 400 kilometres equivalent of national roads from gravel to tarmac, including the construction of 37 new bridges on national roads.

ii. Rehabilitation of 200km equivalent of national roads and 400km of Community Access Roads, and the maintenance of national and District Urban and Community Access (DUCAR) road network;

iii. Rehabilitation, procurement of ferries and construction of selected landing sites including the Laropi, Obongi and Kyoga ferries; and the Bukuungu-Kagwara-Kaberamaido landing sites;

iv. Continue support for the revival of the National Airline and the maintenance of upcountry aerodromes.

v. Acquire right-of-way for the Standard Gauge Railway (SGR); rehabilitate Tororo – Gulu Metre Gauge Railway; and of the KampalaMalaba Metre Gauge railway line; and complete the Gulu Logistic Hub.

59.Mr. Speaker, Shs. 5.1 trillion has been allocated in the budget for the development of the integrated transport infrastructure and related services.

Out of this, Shs. 487.4 billion is for road maintenance, and Shs.135.9 billion is for community roads improvement.

Power Infrastructure

60.Regarding the promotion of renewable energy, the government will commission solar mini-grid plants in Rubirizi and Kasese districts. These include the Kasenyi 37 kilowatts , Kashaka 28 Kilo Watts, Kazinga 26 KiloWatts, Kihuramu 18 KiloWatts, Kisebere 16 KiloWatts, and Kisenyi 32

KiloWatts. These solar mini-grids were constructed by Worldwide Fund for Nature – Uganda. The mini-grids will provide power to isolated community clusters.

61.Mr. Speaker, building capacity to meet the energy needs of Uganda’s population in an environmentally sustainable manner is a major national priority. Key interventions include: –

i. Further development of generation, transmission and distribution capacity;

ii. Increasing electricity access including implementing the free Electricity Connections Policy;

iii. Reducing energy losses and curbing vandalism of electricity infrastructure;

iv. Provide affordable electricity tariffs, including the power subsidy of US$5 cents for manufacturers who qualify as extra-large industrial consumers;

v. Promote renewable energy, energy efficiency and conservation.

62.Mr. Speaker, Shs. 1.1 Trillion has been allocated in the budget for Financial Year 2021/22 for the development of energy infrastructure and services.

Out of this, Shs.646.2billion is earmarked for Rural Electrification.

Digital Transformation

63.Mr. Speaker, ICT is key to enhancing socio-economic transformation and for improving efficiency and productivity. The COVID19 pandemic has presented the opportunity for digital transformation of the economy.

Therefore, the major priorities for Financial Year 2021/22 will include the extension of broadband ICT infrastructure up to the sub-county level; expanding the Digital Terrestrial Television and Radio Broadcasting network to facilitate tele-education for learners; and facilitating the development of software solutions to support eGovernment, eCommerce and ePayment, among others.

64.Mr. Speaker, Shs. 134.9 billion has been allocated in the budget for Financial Year 2021/22 to enhance digitization of the economy.

Pursuing Regionally Balanced Growth

65.Mr Speaker, greater linkage between production and processing facilities at a local level can be established through a regionally balanced growth approach. Regional balanced growth entails the development of value chain enterprises beyond the Central Corridor of Malaba – Greater

Kampala Metropolitan Area (GKMA) – Mbarara. Developing additional corridors of growth will diversify economic development.

66.In this respect, Two additional corridors have been identified namely:- the North-to-East Corridor (Malaba-Soroti-Gulu-Arua) and the North-to-West Corridor (Kasese-Hoima-Gulu-Kitgum). These corridors all together form a Growth Triangle across Uganda where production, value addition and agro-industrialisation can holistically take place. Industrial and Business parks will link production areas to national, regional and international markets. This approach is consistent with the Local Economic Development model that has been developed for the Rwenzori region.

67.Mr. Speaker, the Growth Triangle approach leverages urbanisation as a force for socio-economic transformation. Recently established cities namely Arua, Mbarara, Gulu, Jinja, Fort Portal, Mbale, Masaka, Lira, Soroti and Hoima are located in the corridors of the Growth Triangle. These cities would be centres for industrial and business parks, trade, and serve as centres of excellence in healthcare, education, and hospitality. This will make urban areas more productive and also develop a revenue base for the cities. Strengthening physical planning, and addressing urban crime, pollution, and traffic congestion are key aspects in developing the Growth Triangle.

B. Improving Wellbeing of Ugandans

68.Mr. Speaker, improving the quality of life of Ugandans is central to our Growth Strategy. A healthy population and skilled workforce is a fundamental requirement for socio-economic transformation. Key interventions in education, health, water and sanitation are necessary to ensure effective human capital development.

Health

69.Mr. Speaker, the immediate health need we are faced with is ensuring containment of the CoVID19 pandemic. Widespread vaccination and the enforcement of Standard Operating Procedures are the only preventative measures that guarantee protection against CoVID19. The initial target is to vaccinate at least 6 million most vulnerable persons comprised of teachers, health workers, the elderly and persons with chronic ailments. Shs. 560 billion has been provided for the procurement of vaccines.

70. To enhance the commendable job by the health sector in dealing with the COVID19 pandemic, interventions to improve health workers’ skills and work environment will be prioritised. In addition, health infrastructure will be maintained and systems strengthened to ensure increased efficiency and effectiveness in health care delivery. The use of digital technology will play a key part in not only delivering health skills training, but also in improving systems for greater efficiency.

71.Mr. Speaker, other priorities of the health sector next year include the following:-

i. Upgrade Forty-three (43) health facilities and construct new Health Centre IIIs in sixty (60) sub-counties. To ensure functionality, the recruitment of additional staff for each of the upgraded health facility has been arranged;

ii. Construction and equipping of the Uganda Heart Institute at Mulago will be completed and the Regional Oncology and Diagnostic Centre in Gulu by the Uganda Cancer Institute will be established;

iii. Ensure adequate supply and delivery of essential medicines and health supplies. The National Medical Stores budget has been increased from Shs 420.3 billion this fiscal year to Shs.600.3 billion next financial year.

Education

72.Mr Speaker, transforming education delivery is of paramount importance in improving learning outcomes, especially with the recent experience with the COVID19 pandemic. Adopting e-learning methods and digitizing inspection and supervision to address absenteeism of learners and teachers, will improve learning outcomes. We shall also build on the gains of the universalisation of education and skilling programmes by upgrading more of the country’s education training facilities into effective institutions of learning and skills development.

73.Mr Speaker, next financial year priority, will be placed on improving staffing and teacher quality at all levels; enhancing inspection and supervision of schools, rehabilitate primary and traditional secondary schools and complete construction of selected vocational institutions.

74. To this end, 4,200 primary school teachers will be recruited to raise the national staffing level to 70%. In addition, 1,055 secondary teachers will be recruited in local governments with staffing level below 50% of the establishment. To improve supervision, 440 inspectors will be recruited across all local governments. To address leaner, teacher and school management absenteeism, the Integrated Inspection System (electronic inspection) will be rolled out throughout the country. The rehabilitation of 74 primary and 13 traditional secondary schools, for example Nabisunsa Girls school, will also be undertaken. Construction of 36 partially completed schools, for example Morungatunyi secondary school, will be completed.

Construction of 7 skills development institutions like the Arua School of Nursing will also be completed.

Water & Sanitation Facilities

75.Mr. Speaker, access to safe water and sanitation is important in improving the wellbeing of the population. The target is to increase the coverage of safe water supply in rural areas to 81% and to 100% in urban areas by 2025.

At a minimum we will ensure that every village in underserved districts has at least one safe water source, as well as promote improved sanitation. To this end, Shs.124.9billion has been provided for rural water, and Shs.523.4billion for urban water.

76.Mr. Speaker, in summary, to enhance human capital development, Shs. 7.7 trillion has been allocated next financial year.

C. Peace Security and Good Governance

77.Mr. Speaker, peace and security, the rule of law and good governance, are key to providing a conducive environment to facilitate socio-economic development. Our long-term objective is to maintain peace and security at the community and national level; increase access to justice and enhance effectiveness in public service delivery.

Peace and Security

78.Mr. Speaker, next fiscal year, the following interventions will be prioritized to create a peaceful and secure environment for economic growth and development:

i. acquire, refurbish and maintain military equipment;

ii. Complete the construction of the Military Referral Hospital in Mbuya and train military medical personnel and procure medical equipment;

iii. Commence construction of 30,000 housing units for the military, the construction of the military museum, as well as military barracks; and

iv. improve urban security with implementation of phase III of the Safe City CCTV project.

79.Mr. Speaker, Shs. 6.9 Trillion has been provided in the budget for these interventions.

Access to Justice

80.Mr. Speaker, to improve access to justice, the Judiciary and other law and order services will be deconcentrated to the Regional and District level. In this regard, Shs. 9.4 billion has been provided to kick-start the construction of the Courts of Appeal in Gulu and Mbarara, High Court

Circuits in Luwero and Soroti, Magistrate Courts in Budaka, Alebtong and Lyantonde, Grade 1 Magistrate Courts in Abim, Patongo, Karenga, and Kyazanga.

81.Mr. Speaker, the budget of the Judiciary was substantially enhanced from Shs 199.1billion to Shs.376.9 billion. Out of this, Shs. 146.6 billion has been provided for the recruitment and facilitation of Judicial staff. In addition, Shs. 18.2 billion has been provided to implement the Electronic Court Case Management Information System and the Prosecution Case Management Information System.

Improving Budget Efficiency

82.Mr. Speaker, efficiency in public spending not only ensures public funds are well spent but also enables other priority needs to be funded. Next financial year, expenditure is projected to decline by 3.4% of GDP to 21.1% from 24.4% this financial year. It is projected to average 19.3% over the medium-term. The following interventions will improve efficiency in public spending:-

i. Rationalization of Government institutions to eliminate mandate overlaps and duplication;

ii. Improved asset management, including maintenance of public infrastructure, and improving Government fleet and equipment management using leasing options;

iii. Strengthened procurement by sanctioning officials and other persons who unduly influence procurement processes;

iv. Elimination of the accumulation of domestic arrears by clearing existing stock of arrears and curtailing further accumulation. Sanctions will be applied to Accounting Officers in accordance with the Public Finance Management Act 2015, if there is further arrears accumulation;

v. Enhanced budget monitoring and evaluation by strengthening executive oversight for improving efficiency in public policy, programmes and projects implementation;

vi. Digitization of public financial management systems through automation and integration of ICT systems to ensure timely release and disbursement of funds. Use of National Identification Numbers upgraded with enhanced biometric features will improve efficiency in government transfers to beneficiaries using mobile money. This will be used in transfers under the Social Assistance Grant for the Elderly and the Emyooga seed capital;

vii. Further scale-down on spending on consumptive items such as travel abroad just like we have done during the COVID19 pandemic. Savings of Shs. 800 billion have been identified.

83.Mr. Speaker, the new programmatic approach to budgeting under NDPIII will enable removal of the silo mentality in Government Departments and align the budget to the results we want.

IV. FINANCIAL YEAR 2021/22 FINANCING FRAMEWORK

84.Mr. Speaker, the fiscal strategy for Financial Year 2021/22 and the medium-term aims to create resources to finance priority interventions, while maintaining fiscal and debt sustainability. It is premised on mobilizing a higher level of domestic revenue and enhancing returns from public investment. The Government will also undertake a review of public expenditure to improve efficiency.

Domestic revenues

85.Mr. Speaker, domestic revenue for next financial year is projected at Shs 22,425 billion, equivalent to 13.8% of GDP, compared to a projected outturn of Shs 19,432 billion, equivalent to 13.1% of GDP in FY 2020/21.

This target revenue is an increase of 0.7%age point of GDP. The increase in tax collections will be realized from an improvement in the level of economic activity, increased efficiency in tax collection by URA through strengthening compliance and enforcement, as well as new tax measures and administration reforms.

Tax Policy Interventions

86. Accordingly, I will highlight some tax policy interventions which will be implemented in Financial Year 2021/22: –

i. Reform taxation of rental income to remove the incentive for nonindividual rental taxpayers to claim unrestricted deductions which significantly reduce their tax contribution.

ii. Reduce rates of depreciation for some classes of assets.

iii. Discontinue the concurrent deduction of initial allowances and depreciation in the first year of use of qualifying assets.

iv. Review the capital gains tax regime by allowing for the effect of inflation and providing tax relief for venture capital investments.

v. Broaden the scope of taxation of plastics to cover all plastics

vi. Rationalize the Excise Duty regime on telecommunication services by scrapping the excise duty on Over the Top (OTT) and introduce a harmonized excise duty rate of 12.0% on airtime, value-added services and internet data excluding data for provision of medical services and the provision of education services.

vii. Introduce an export levy of 7% on the value of fish maw exports.

viii. Impose an export levy of 5% and 10% on processed and unprocessed gold and other minerals respectively.

Tax Administration Measures

87.Uganda Revenue Authority will implement administrative interventions

to boost revenue collection including the following:-

i. Strengthen tax arrears management and recovery;

ii. Enhance data analysis through interfaces with other Government information systems to enhance taxpayer compliance;

iii. Enforce tax compliance using the Electronic Fiscal Receipting and Invoicing Solution (EFRIS) and Digital Tax Stamps;

iv. Enforce enhanced licensing requirements for clearing and tax agents, and bond operators;

v. improve detection of smugglers using non-intrusive inspection equipment, and

vi. Close all bonded houses for imported sugar for re-export to avoid undeclaration and misclassification

88. These administrative measures will generate about Shs. 800 billion in revenue collections.

89.Mr. Speaker, the capacity of local governments to collect revenue will be enhanced through training and ICT infrastructure.

Public Debt Sustainability

90.Mr. Speaker, Uganda’s debt amounted to US$ 17.96 billion as at 31st December 2020, equivalent to 49.8% of GDP. Borrowed funds have been used to finance mainly infrastructure projects such as the Karuma and Isimba hydropower plants, oil roads, development of airports industrial parks, transmission lines, water and irrigation projects.

91. Uganda public debt remains sustainable in the short, medium and long term. I reaffirm Government’s unwavering commitment that Uganda shall continue to honour its debt obligations as they fall due. Uganda will not default on repayment of its debt. All contractual debt obligations will be fully honoured.

92.Mr. Speaker, the Government will undertake the following key strategies, among other, to keep our debt within sustainable levels: –

i. ensure that projects are well appraised to allow only those that are viable and aligned to the national development plan;

ii. prioritise borrowing for only projects that enhance socio-economic transformation, and enhance project implementation;

iii. Prioritize borrowing from concessional sources; and

iv. Increase the maturity profile of our domestic debt.

Resource Envelope for Financial Year 2021/22

93.Mr. Speaker, the Resource Envelope for Financial Year 2021/22 amounts to Shs. 44,778.8 billion and is comprised of both domestic and external resources as detailed below: –

i. Domestic Revenue amounts to Shs 22,425 billion of which Shs. 20,837

billion will be tax revenue and Shs 1,588 billion will be Non-Tax Revenue.

ii. Domestic borrowing amounts to Shs 2,943 billion.

iii. The Petroleum Fund resource amounts to Shs 200 billion.

iv. Budget Support accounts for Shs 3,583 billion.

v. External financing for projects amounts to Shs. 6,868 billion of which Shs.

5,519 billion is from loans, and Shs. 1,349.4 billion is from grants.

vi. Appropriation in Aid, collected by Local Governments amounts to Shs.

212.4 billion; and

vii. Domestic Debt Refinancing will amount to Shs 8,547 billion.

94.Mr. Speaker, total expenditure will be Shs.44.778.8 billion. Excluding domestic debt refinancing and Appropriations in Aid (AIA), it amounts to Shs. 36,019.4 billion of which Wages and Salaries is Shs. 5,528.6 billion, Non-wage Recurrent Expenditure is Shs. 15,625.4 billion and Development Expenditure is Shs. 14,865.3 billion.

CONCLUSION

95.Mr. Speaker, the economic growth strategy and budget priorities that I have presented today seek to speed up economic recovery and drive more inclusive growth by creating an environment for increased socioeconomic empowerment of the ordinary Ugandans.

96.Specific focus in the coming budget has been placed on implementing the parish development model which provides a unique opportunity for transforming the subsistence households through productivity enhancement, jobs, and the empowerment of youth and women.

Investments in oil and gas will provide opportunities for both direct and indirect jobs, including local enterprises development. Market infrastructure development will guarantee export markets for our products. Addressing constraints in infrastructure and agriculture as well as improving service delivery, will improve our competitiveness and accord Ugandans a better quality of life.

97. I therefore commend this budget to the people of Uganda, as we continue implementing actions to transform our economy from subsistence to a modern one.

FOR GOD AND MY COUNTRY