BY URN.

President Yoweri Museveni says he now has the final say on Uganda’s loans acquired from both internal and external lenders.

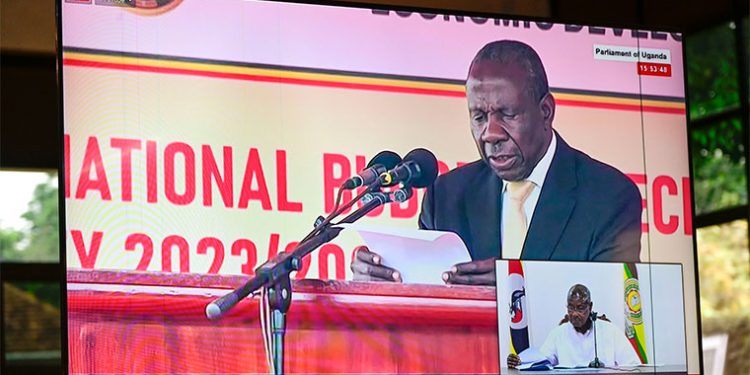

Speaking at the conclusion of the Shs 52 trillion budget speech for 2023/2024, Museveni blamed the appetite for borrowing on indiscipline in government spending. He said some of the loans were actually not necessary.

Museveni addressed parliament virtually from Statehouse Nakasero where he has been in self-isolation after he tested positive for COVID-19 virus. He began his address by asking the minister of Finance to crosscheck some of the figures on the performance of the economy.

He then assured Ugandans that he was not under intensive care as rumoured on Kenyan social media spheres. Turning to the issue of public debt, Museveni revealed that he has personally taken over the role of final approval for external loans.

The president is technically in charge of the finance docket though he delegates it to the Finance minister and his state ministers.

“You heard your budget of Shs 52 trillion. While I support that budget because there is no other solution in the short-run, it is important to know that Shs 17 trillion of that budget, is to pay debts. Many of these debts, were being pushed by the neo-colonial public servants, until recently when I put down my foot and insisted on approving every loan,” said Museveni.

By the end of the year 2022, the country’s indebtedness was Shs 80.2 trillion, according to the ministry of Finance, Planning and Economic Development, but speaker of parliament Anita Among says the record they have is in fact Shs 80.8 trillion.

President Museveni also accused the Uganda Revenue Authority (URA), of not doing enough to raise domestic revenues which would reduce the need for borrowing. URA has now been given a target of collecting Shs 29 trillion, which is more than Shs 4 trillion above this year’s target, which is also not certain of being achieved.

Civil Society Budget Advocacy Group chief executive officer, Julius Mukunda criticized the target set by the ministry of Finance, saying URA has over the years consistently failed to hit the target, and so the government sets its budgetary decisions on the wrong grounds.

Museveni said the 13 per cent GDP ratio is too low, and URA is underperforming but has hope that this will improve.

“The way forward is that we should borrow less or not borrow at all. With discipline, we do not have to borrow at all. URA is also still under collecting taxes, they are also not doing good work. Their tax GDP ratio of 13 per cent is not serious. In Europe, countries like Holland have a tax GDP ratio of 39 per cent. However we say in our language here…when a cattle keeper still has life, he will get new cows even if the old ones died. We shall learn from the mistakes of the past and perform better,” added Museveni.

Finance minister Matia Kasaija said the government is focusing on improving revenue collections as well as cutting public expenditure. The theme of the 2023/2024 budget is “Full Monetisation of Uganda’s economy through Commercial Agriculture, Industrialisation, Expanding and Broadening Services, Digital Transformation and Market Access.”

Among the measures, the government says it will not purchase new vehicles except for revenue mobilisation, security operations and agricultural activities. It also plans to limit foreign travel to a few officials, as well as rationalising the tax exemption policies to reduce revenue lost in these incentives. But such talk like in previous budget normally only remains on paper.

Kasaija says the targeted revenue collections this year are part of the efforts to increase revenue collection levels to at least 14 per cent next year and further increase it to between 16 and 18 per cent.

Minister Kasaija said the government has put in place several measures that will ensure not only better revenue collections but also enhance government spending discipline. He said the government is also cautious about borrowing domestically to avoid suffocating the local private sector that relies on local loans.

This, he said will be done amidst reduced borrowing on commercial and non-concessionary loans, which are expensive. He says such loans will only be limited to projects with high economic returns.

On the mismanagement of public expenditure by officials, Kasaija said there are measures that have been put in place to ensure the smooth running of government projects.

These will include negotiations with lenders on the smooth implementation of funded projects and ensuring that before a project is approved for funding, there should be selection, design, approval and analysis made before approval for funding.

He also revealed the creation of a land acquisition fund that will address delays in compensation. The increased public borrowing amidst public expenditure is a pressure on the economy. We want to request that we reduce on public borrowing.

The high unit cost of implementing the infrastructure projects notably in sustainable energy development and integrated transport infrastructure and service programs is mainly attributed to over-dependence on foreign entities and supervised by foreign persons who are paid highly instead of making sure that our local content is encouraged and given work to be done. Continued accumulation of domestic arrears in a disruptive effect of performance of the private sector,” said Kasaija.

BY URN.

President Yoweri Museveni says he now has the final say on Uganda’s loans acquired from both internal and external lenders.

Speaking at the conclusion of the Shs 52 trillion budget speech for 2023/2024, Museveni blamed the appetite for borrowing on indiscipline in government spending. He said some of the loans were actually not necessary.

Museveni addressed parliament virtually from Statehouse Nakasero where he has been in self-isolation after he tested positive for COVID-19 virus. He began his address by asking the minister of Finance to crosscheck some of the figures on the performance of the economy.

He then assured Ugandans that he was not under intensive care as rumoured on Kenyan social media spheres. Turning to the issue of public debt, Museveni revealed that he has personally taken over the role of final approval for external loans.

The president is technically in charge of the finance docket though he delegates it to the Finance minister and his state ministers.

“You heard your budget of Shs 52 trillion. While I support that budget because there is no other solution in the short-run, it is important to know that Shs 17 trillion of that budget, is to pay debts. Many of these debts, were being pushed by the neo-colonial public servants, until recently when I put down my foot and insisted on approving every loan,” said Museveni.

By the end of the year 2022, the country’s indebtedness was Shs 80.2 trillion, according to the ministry of Finance, Planning and Economic Development, but speaker of parliament Anita Among says the record they have is in fact Shs 80.8 trillion.

President Museveni also accused the Uganda Revenue Authority (URA), of not doing enough to raise domestic revenues which would reduce the need for borrowing. URA has now been given a target of collecting Shs 29 trillion, which is more than Shs 4 trillion above this year’s target, which is also not certain of being achieved.

Civil Society Budget Advocacy Group chief executive officer, Julius Mukunda criticized the target set by the ministry of Finance, saying URA has over the years consistently failed to hit the target, and so the government sets its budgetary decisions on the wrong grounds.

Museveni said the 13 per cent GDP ratio is too low, and URA is underperforming but has hope that this will improve.

“The way forward is that we should borrow less or not borrow at all. With discipline, we do not have to borrow at all. URA is also still under collecting taxes, they are also not doing good work. Their tax GDP ratio of 13 per cent is not serious. In Europe, countries like Holland have a tax GDP ratio of 39 per cent. However we say in our language here…when a cattle keeper still has life, he will get new cows even if the old ones died. We shall learn from the mistakes of the past and perform better,” added Museveni.

Finance minister Matia Kasaija said the government is focusing on improving revenue collections as well as cutting public expenditure. The theme of the 2023/2024 budget is “Full Monetisation of Uganda’s economy through Commercial Agriculture, Industrialisation, Expanding and Broadening Services, Digital Transformation and Market Access.”

Among the measures, the government says it will not purchase new vehicles except for revenue mobilisation, security operations and agricultural activities. It also plans to limit foreign travel to a few officials, as well as rationalising the tax exemption policies to reduce revenue lost in these incentives. But such talk like in previous budget normally only remains on paper.

Kasaija says the targeted revenue collections this year are part of the efforts to increase revenue collection levels to at least 14 per cent next year and further increase it to between 16 and 18 per cent.

Minister Kasaija said the government has put in place several measures that will ensure not only better revenue collections but also enhance government spending discipline. He said the government is also cautious about borrowing domestically to avoid suffocating the local private sector that relies on local loans.

This, he said will be done amidst reduced borrowing on commercial and non-concessionary loans, which are expensive. He says such loans will only be limited to projects with high economic returns.

On the mismanagement of public expenditure by officials, Kasaija said there are measures that have been put in place to ensure the smooth running of government projects.

These will include negotiations with lenders on the smooth implementation of funded projects and ensuring that before a project is approved for funding, there should be selection, design, approval and analysis made before approval for funding.

He also revealed the creation of a land acquisition fund that will address delays in compensation. The increased public borrowing amidst public expenditure is a pressure on the economy. We want to request that we reduce on public borrowing.

The high unit cost of implementing the infrastructure projects notably in sustainable energy development and integrated transport infrastructure and service programs is mainly attributed to over-dependence on foreign entities and supervised by foreign persons who are paid highly instead of making sure that our local content is encouraged and given work to be done. Continued accumulation of domestic arrears in a disruptive effect of performance of the private sector,” said Kasaija.