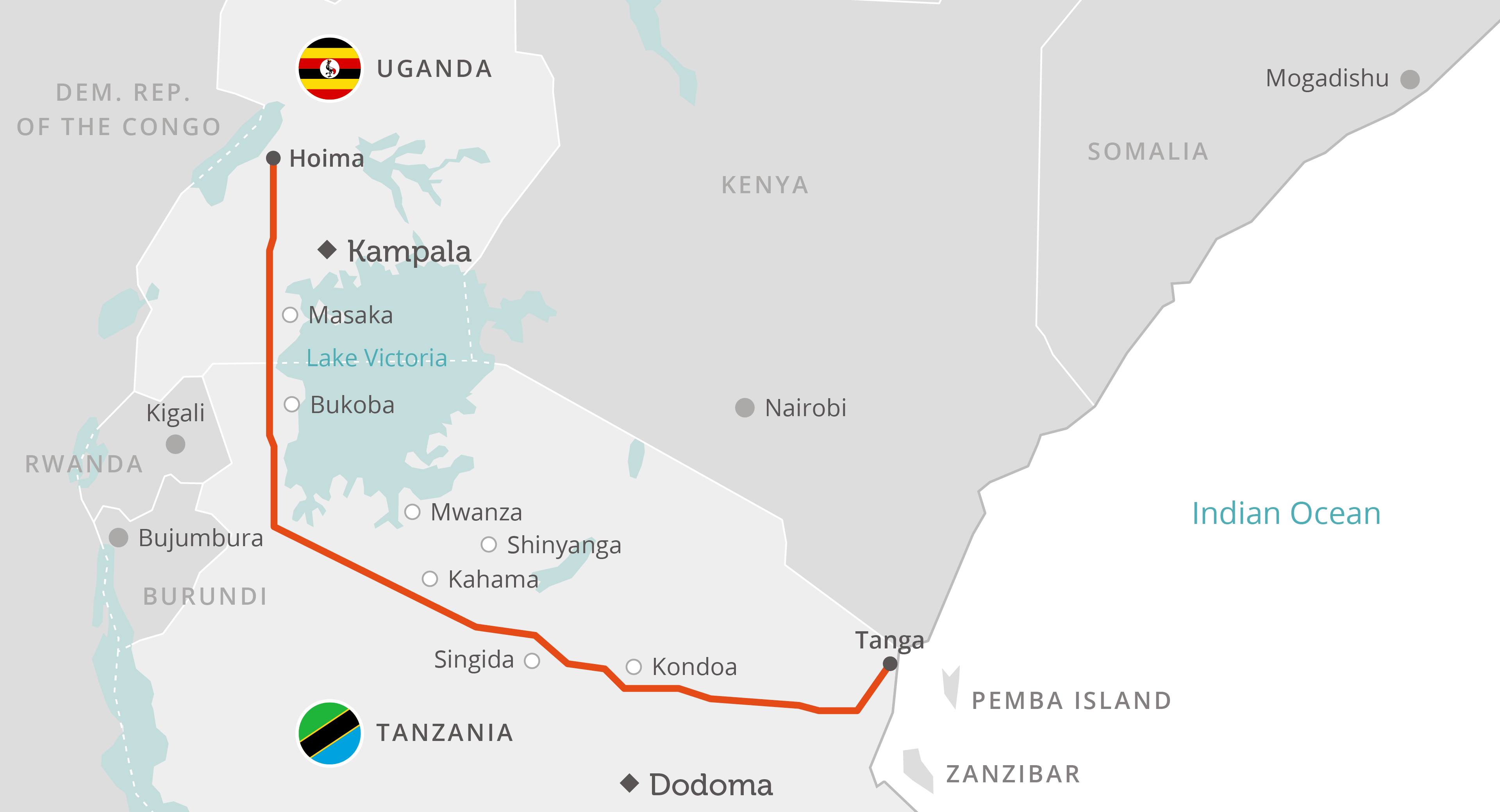

Six major French Banks have refused to fund the much anticipated East African Crude Oil Pipeline (EACOP)-pictured above, a 1,445-kilometer heated stretch through Uganda to Tanzania, according to reports from agencies this week.

The French banks, BNP Paribas, Société Générale and Crédit Agricole, will not be financing the East African Crude Oil Pipeline (EACOP). Barclays, Credit Suisse and ANZ had already refused.

BankTrack, an international tracking, campaigning and CSO support organisation targeting private sector commercial banks (‘banks’) and the activities they fund, reported on Friday that following an open letter to banks signed by over 260 civil society organizations over abuses by Total to human rights and the environment, French Banks had declined to finance EACOP.

It is thought the EACOP will fuel climate change by transporting oil that will generate up to 34 million tons of carbon emissions each year, and together with the Tilenga and Kingfisher oil fields will negatively impact more than 120,000 individuals along its route.

It also poses risks to wildlife and water resources relied on by millions of people for their livelihoods. Total’s response to the mounting concerns surrounding the project has been criticized as greenwashing and lacking transparency.

The pipeline is expected to cost more than $3.5 billion, of which $2.5 billion will come from a project finance loan. Recent months have seen one potential financier after another distance themselves from the project as global opposition to the project builds.

The UK’s Export Credit Agency, UKEF, also ruled the project out for finance last month, as it moved to implement a decision to stop financing fossil fuel projects overseas. And last year, the African Development Bank also ruled out direct finance for the project, saying that it sees renewable energy as the future for the continent.

On Wednesday, French daily Les Echos reported that it discovered that the project’s sponsor, French oil major Total, will have to do without the financial support from the three banks.

“The decision has been made, the project is too hard to defend,” sources within the banks said although no official statement has yet to issued.

The news will be a blow, just two weeks after Total, its partner CNOOC and the governments of Uganda and Tanzania signed a series of agreements in Entebbe, Uganda aimed at kicking off construction of the pipeline, although financing for the project has still not been secured. President Yoweri Museveni and Tanzanian President Samia Suluhu witnessed the signing of agreements.

The first commercial oil discovery in Uganda was made in the Albertine Graben area in 2006. Since then, successful well appraisals have boosted Uganda’s proved crude oil reserves from zero in 2010 to 2.5 billion barrels as of the end of 2015, according to the Oil & Gas Journal (OGJ).

Do you want to share a story, comment or opinion regarding this story or others, Email us at newsdayuganda@gmail.com Tel/WhatsApp........0726054858